Summer 2021: There is no Vaccine for Violence

Prediction: Summer 2021 is going to be abnormally violent. And summer 2022 as well. It is the new normal.

“When you come out of the storm, you won’t be the same person who walked in. That’s what this storm’s all about.”

― Haruki Murakami, Kafka on the Shore

As I write this on the last day of January, a strong winter storm is beginning to blanket violence scarred cities from Chicago to DC and to Boston. The storm will provide a short respite for traumatized communities—routine activities will be disrupted and people will shelter. Violence, for an all too brief moment, will be smothered in a blanket of calm. As the snow melts, people will return to their routines, whether those are centered on work or school or family, or anxieties and trauma, or nursing grievances and resentments and a thirst for revenge.

Last year, I wrote a little bit of an explainer on the extremely high rates of violence in most US cities in 2020. The general sense of the media is that last summer was unusually dangerous because of protests—either because the protests themselves caused a wave of lawlessness, or because the lawlessness of the police delegitimized authority. I argued that a simpler explanation was more likely true: that large numbers of young men in disadvantaged places were separated from work and school and positive institutions, and that the disruption in their routine activities led to violence with other young men in the exact same situation, suitable targets with whom there were long-simmering beefs, just right there, just up the street.

Now, as we contemplate the coming warmer months, it is time to think hard about the explosion in violence last year and what it means for the coming year. Officially, we don’t know for sure how much crime and violence increased in the US in 2020, and won’t until the FBI real-time surveillance data coughs up an estimate sometime this fall. Or maybe next winter. Or maybe not at all. (See my next note below on why we may not know much of anything about violence in America next summer.)

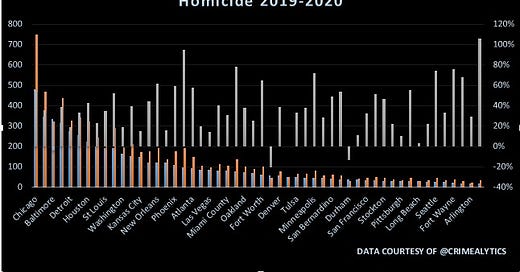

The graph that follows helps frame the problem. What we do know comes from private citizens and scholars who put together the unofficial data themselves. The data are from Jeff Asher (@crimealytics) who estimated that homicides increased 36.7% in 57 of the biggest cities in the US in 2020. Across all of the US, that likely translates into at least a 2X increase in US homicides from 2018 to 2019. That is, by far, the biggest one-year increase in violence in the last half-century. In the graph, the blue vertical bars represent 2019 homicide and the orange bars 2020 homicides, with the counts shown on the left axis. The light colored bars show the increase, with the percentages on the right axis. Out of the 51 cities (I dropped cities with less than 10 homicides), only three showed a decline.

Summer, 2021

What does this mean for next summer? By far the best predictor of future crime and violence is prior crime and violence, which is obviously a bad portent for 2021. On the other hand, 2020 was a substantial deviation from 2019. So the natural question is: will the factors that caused the dramatic rise in 2020 repeat in 2021?

I think this is the wrong question. The key question to me is whether the effects from 2020—whether they caused the 2020 violence or not—will cause more violence in 2021. I think they will. And I worry that they create new structural barriers to reducing crime and violence that will continue far into the future.

This is a complex story, but here are what I think are the top five headlines for the summer of 2021.

1. Routine activities will continue to be disrupted in summer 2021. I argued that disruptions to routine activities in 2021 put bored, scared, angry, disconnected youth with a history of beefs close together. 2021 looks better, but how much better? Not much better is my guess. The kinds of institutions that support young people in the most disadvantaged communities will be the last to recover. Community-based organizations, government-led programs, government-supported programs, schools, churches, local retail, etc. will all be the last to see their revenues return to 2019 levels. Will they recover by 2022? 2023? It’s an open question.

2. Hurt people hurt people. The decisive risk factor causing violence in a community is trauma in the community. Loss of family and friends to violence erases hope and opportunity. Time heals, but only in times of peace. And with much more violence and death in 2020, there is no peace on the horizon to end the cycle of retaliation. More revenues for supportive local institutions is a big part of the answer, but they are not coming soon enough.

3. Illegitimacy. Did the protests cause lawlessness and violence or did lawless police cause the violence and the protests? Put another way, will an increase in violence that will likely result from the increased perception of police illegitimacy that blossomed in 2020 outweigh any benefit from fewer protests in 2021? My take, from what empirical data is available and from my discussions with people who work with disadvantaged communities, is that the danger from growing perceptions of police illegitimacy is far greater than any gains from less protest-related violence. And, the literature on big picture attitudes about legitimacy and trust suggests that these are relatively time-invariant—once minds are changed they tend to stay changed. Policing illegitimacy is now a bigger structural problem than in 2020.

4. Disinvestment and intensified disadvantage (the spatial lag effect). One of the absolutely most disheartening trends from 2020 is the spread of violence. Over the last decade, evidence-based practices were beginning to have tangible positive effects in places with the most cumulative disadvantage. 2020 not only stopped that trend, it reversed it and it spread it—to neighboring communities. These neighboring communities which had been successful in keeping at bay the worst of the concentrated violence are now literally in the firing line. And that creates a need for even more of the community institutional resources that are not available, more trauma supports, more legitimate policing and more investment in general. In particular, there is a strong negative effect between investment in businesses and neighborhood violence. This weakens the tax base, creating the cycle of disinvestment, reduced revenues, and more disinvestment. This hollowed our cities in the 1960s, 70s, and 80s, it cannot be allowed to happen again. It must be prevented.

5. Guns. The Trace maintains a count of gun sales in the US and the picture it generates is jaw-dropping. The US is under siege from COVID-era firearms purchases. Make no mistake, there is leakage from legal gun purchases, from guns stolen from cars and trucks and homes, and sold directly or indirectly into illicit markets. These guns will turn fistfights into gunfights. It’s unavoidable. It’s fate.

Every illegal gun is a policy failure.

Data sourced from The Trace: https://www.thetrace.org/2020/08/gun-sales-estimates/

In sum, a COVID vaccine is no magic wand for violence in America. It is likely that violence in the US, particularly in cities, has been rest at a new, higher equilibrium.

What’s going on with US Crime Data? What has changed and what it means.

I will let the FBI address the massive change in how the US collects and disseminates crime data in their own words. “As recommended by our law enforcement partners and approved by the FBI, the UCR Program retired the SRS and transitioned to a NIBRS-only data collection on January 1, 2021. Law enforcement agencies are encouraged to start implementing NIBRS now. The FBI remains committed to assisting all agencies in making the switch.”

What does that mean? It means the crime data you are used to seeing—summary monthly statistics (SRS) from most of the 18,000 US law enforcement agencies have been phased out. In their place is data collected from NIBRS, which is incident-based data. This is a really good thing—having data about each criminal incident is so vastly superior to the old SRS system it defies superlatives. But it’s only better data if we get the data. Here’s the graphic from the FBI I pulled up today—January 31, 2021, which is 31 days after the FBI theoretically switched systems.

In the upper-right text, you see the jaw-dropping number: agencies contributing NIBRS: 51%. The light shading means no NIBRS data from New York, California, and Florida. Hopefully, the problem is that it is just an old graphic and everything is going swimmingly behind the scenes. So I tried to figure out what is going on behind the scenes. It’s … complicated.

From the website, NIBRS appears to be under the jurisdiction of the Federal Bureau of Investigation (FBI) Criminal Justice Information Services (CJIS) Advisory Policy Board (APB) Ad Hoc Subcommittee (sadly, no acronym was supplied for the ad hoc subcommittee). I can find a Federal Register notice that a CJIS Advisory Policy Board meeting was scheduled in December and there are filings about its charter, via FACA. The link in the FACA document to the committee website is dead, and there is nothing public that can be found, at least not without a master’s in public administration.

So who knows? But I am sure that once NIBRS is up and running at 100%, data will be disseminated in a timely and useful fashion. Right out the door, right away, we will get that data to the public and policymakers so we can react to what is happening in the summer of 2021 in real-time.

Why the Filibuster is Here to Stay

In other news, a lot has been said about whether the senate should terminate the cloture rules that require 60 votes to end a filibuster. But there is simple game theory reasoning that explains why this is not going to happen in a 50-50 senate.

Basic strategy of congressional negotiations is to force the other party—or at least key members of the other party—into gut-wrenching votes. Particularly odious are votes where the truth is clearly on one side and the senators’ constituents are on the other. In the Senate, it is not enough to win, there must be losers too. The key bit of math is that 50-50 votes create far less than 50 losers, often only a handful.

Now, imagine for a minute you are Joe Machin (D-WV) or Krysten Sinema (D-AZ). You are the most conservative members of your caucus and your constituents hold many positions that are anathema to the rest of the democratic caucus. In the 60-vote supermajority world, you are protected. Any vote that makes you queasy makes the Republicans just to your conservative right apoplectic. Any potential 50-50 vote, therefore, gets filibustered to death, and that is great for you. Absolutely terrific.

A 60 vote supermajority means you never have to pull the lever in a palms are sweaty, knees weak, arms are heavy, there's vomit on his sweater already, vote. It means never having to choose between your party and your constituents, which is a guaranteed loser.

So, why is the so poorly reported? Because the narrative is dumb and it is fun to talk about the ‘Joe Manchin is the most powerful member of the Senate’ banner that is riddled with logical flaws. And you better believe Joe Manchin knows this all too well. When you see him on cable, he inevitably gets the “what is it like to be the most powerful man in the Senate” question. And he shrinks from it and denies it. Perhaps because he is modest or has humility but more importantly because not only is this not true, the opposite is true.

Joe Manchin is the most vulnerable member of the Senate. And the only thing protecting him is the filibuster. So, it stays.

Gamestop was not David versus Goliath, it was Business as Usual on Wall Street

This was a fun week on Wall Street. And it was a littlebit David versus Goliath. If you are like me, you were rooting for the underdog, the retail investor, the Redditors. And you tasted the delicious schadenfreude of Petrified Wall Street. If you are more of an establishment type or see Reddit as a toxic cesspool of mindless conspiracy bile, why, you had your day too! Good times for everyone.

But here’s the thing. The real work of Wall Street went on uninterrupted. As usual, it had nothing to do with directing capital to its most economically productive use as the Efficient Market Hypothesis would have you believe.

The simple version of the story is that Gamestop (GME) as a company is in a terrible situation. Its brick and mortar business is drying up, and it has no clear digital path to success. Giant hedge funds have seen this for months and placed great bets that the end is nigh. They borrow shares and short them, betting that they can sell a share today and then buy it back tomorrow at a much lower price and pocket the difference. Elon Musk rantings aside, there is nothing inherently wrong with this.

Now, the story takes a little bit of an unexpected turn when these pros got too greedy and borrowed more shares to short than there are shares in the float! Enter your favorite Wall Street Maxim. Bears make money, bulls make money, pigs get slaughtered. So here come the hedge fund pigs to the slaughter. In the popular narrative, the slaughterers are the Redditors who cleverly see that by shorting all the shares of GME, the hedge funds have backed themselves into a corner. If there is sustained buying in GME, and the key is sustained, GME will be got in a cycle from which there is no escape.

The mechanics are straightforward. You are a hedge fund. You borrow some shares of GME when it is trading at $20 (for a small fee) and sell the shares with the goal of buying them back when the price crumbles to $5. Your gains will be massive, $15 per share divided by whatever fee you paid. Maybe 30X! Gold mine! Money for a new estate in the Hamptons and in Aspen and the fractional NetJets ownership to get you there.

In march the Redditors. It’s a company they all know, in a business they understand, with an easy investment strategy. Buy! Keep buying! Never sell! Diamonds!

So, instead of the price going to $5, the buying drives it up to $40. Now the hedge fund shorts are in whopping trouble. The people they borrowed the shares from want their GME shares back so they can sell at $40 and pocket their own 2X. (Note: who loaned these shares in the first place? Not Redditors of course, but the big broker-dealers, the Goldman Sachs of the world. Business as usual).

And the spiral begins. Every time a Wall Street hedge fund sells to cover its bad short position an angel gets its wings and the price goes up.

As long as the Redditors hold fast and don’t sell, or better yet, keep buying, the squeeze gets tighter and tighter and the price keeps going up. Despite super-clumsy efforts to cut off Redditors and save the hedge funds, on Friday morning January 29th, GME gapped the open from a Thursday close of $193 to an opening price of $380. (Note: another old Wall Street maxim is that gaps always get filled, so don’t buy the gap.) Anyway, this last day of January, the stock is at $325 per share and Wall Street knickers are kerfuffled.

At some point, of course, the stock is almost certainly going back into the single digits. but as the self-help gurus say, it’s not the destination, man, it’s the journey.

Why this is Business as Usual

Anyway, that’s the story in the media. But there’s a clue in all of that that there is a lot more going on behind the scenes. On Thursday, more than 55 million GME shares changed hands, that’s $10-15 billion in trades. Now, there are many Redditors leveraged to their eyeballs and fooling around with derivatives, but in order to believe this is all Redditor driven, you have to believe that there are ten million Redditors buying and selling GME and each and every one averaged $1,000 in trades in one day.

When I look at Reddit r/WallStreetBets, I don’t see anything like that. From the chatter, which is the only data I’ve seen, you might be able to convince me that one million Redditors averaged $100 in trades on Thursday, though I think that’s probably high. So, where did the other billions in trades come from?

Business as usual. Wall Street bankers get tears in their eyes and get emotionally needy just imagining this kind of volatility. It is a utopia. Wall Street exists to exploit volatility. Rent-seeking for everyone. So, how do they do it?

One way is through pricing spreads—on Friday, in pre-market, the bid-ask spread on GME was $35! That spread is usually measured in basis points or fractions of a penny. That’s money that goes directly into the market makers’ pockets. How much? GME had more than 5 million shares traded in the Friday pre-market. $35 X 5,000,000 = a lot of money. It happens of course, to a lesser extent, all day during regular trading hours.

Another way is through arbitrage. When stocks get volatile, the extremely short-term price jumps around, but it jumps around a bit differently in different markets for the stock. Often the options market—which has a price to purchase the right to buy or sell a stock at a future date—is out of line with the actual price of GME. Hedge funds use lightning-fast computers to identify these price differentials and buy in one market and sell in another pocketing the difference until the prices hit an equilibrium. Only, when the price is super volatile, these prices never stay in equilibrium so you can exploit this all day long. Free money!

But the best way is through high-frequency trades (HFT). RobinHood, the favored app of the Reddit-set, does not charge a fee on a trade (almost no retail brokerage does these days). So. How on earth does Robinhood make any money and stay in business? Easy. They sell your trade to someone else to actually execute. That is often a high-frequency trader.

Now, the HFTs have many ways to make money off your trade. First, of course, they can also pocket the spread. Stock quotes are just an approximation in a world with high-speed trading, so a share at $50.02 can be a fraction of a cent lower or higher. HFTs, who measure time in thousandth or millionth of a second, can exploit these tiny price differences and put that money in their pocket. The retail customer doesn’t think in those terms and generally is just delighted that bought the stock at around $50 and not at $55. But the HFTs do these trades millions of times a day, it’s all automated, so it is free money, and lots of it.

Or, the HFT could front-run. In a fraction of a second, before the HFT executes your trade, they put their own trade in front of your trade. Then your trade comes through, but their trade bumped up the price just a teeny bit. And now your trade bumps it up a teeny bit more (this creates the spread that they pocket). And then they sell their position at the new teensy bit higher price. And pocket the difference. Rinse and repeat all day long, the HFTs essentially trade the same dollar over and over. All it requires is volume and volatility. With a stock in crazy swings and high volume like GME, it’s a printing press.

Michel Lewis, who is the greatest nonfiction storyteller of our time, for my money, wrote about all of this in 2015 in Flash Boys. The upshot is that all you learned in high school economics about capital chasing productive uses is just a charming anachronism. Regardless of what happens in Reddit or Main Street, someone on Wall Street always wins.

The efficient market hypothesis is dead. Long live the efficient market hypothesis!

Video Interlude

I was blown away by Amanda Gorman at the inauguration. I think this, perhaps the greatest inspirational speech ever delivered in a movie, is just right in describing my reaction to her six-minute poem.

A lot of people are buying guns this year because they know your kind want them disarmed and helpless against murderous criminals.

Your comment about the filibuster is exactly what I've been saying since Ossoff and Warnock won but there are other reasons why I think the filibuster will survive. I worked in the Senate for three years and I think that gives me some level of expertise.

Not only does this expose Democrats to tough votes during cloture votes, it also permanently weakens the power of individual Senators. No more Rand Paul filibusters to get assurances that that Americans can't get drone striked on American soil. No more Chris Murphy filibusters to get votes on gun control. Finally, with such a thin majority, it's not killing the 60-vote threshold would mean Democrats would increase their chance of major policy victories substantially. If they had a 52 or 53 majority, they'd have room to spare and I'd say it might make some political sense to go nuclear. But there's a chance they do so and still can't unite the caucus to pass voting rights, gun control or any other number of gun control measures in the 117th Congress.